Chargebacks are part of selling online, even for well-run stores. Banks are mandated to protect cardholders; customers escalate when expectations break; and sellers must answer with evidence and process, not assumptions. This guide reframes the official concepts into a seller-first operating plan: what a chargeback is, how it flows on Amazon, which proofs to send (and how to package them), how it affects Account Health and ODR, and the preventative moves that reduce disputes without over-refunding. You will also find checklists, tables, and timeline playbooks you can reuse with your team.

Table of Contents

What a chargeback is (vs refund and A-to-z)

A chargeback is a bank-mediated reversal of funds on a disputed transaction. The cardholder contacts their bank; the bank grants a provisional credit; the seller may represent the case with evidence; and the bank makes the final decision. A refund is a direct resolution between customer and seller inside marketplace policy. An A-to-z Guarantee claim asks Amazon to review a dispute when a buyer believes policy was not respected.

In practice, the same customer frustration can surface through any of the three. Your job is to pick the fastest, fairest resolution path given evidence, timing, and cost.

Typical reasons claimed by customers

- Transaction not recognized or suspected fraud

- Product not received

- Item not as described; defective or damaged

- Duplicate or incorrect billing

- Return sent but refund missing

- Partial shipment or wrong variant received

Key process facts

• Banks mediate and decide outcomes.

• The full cycle may take up to ~90 days from cardholder initiation.

• If you are emailed by Amazon, reply within 7 calendar days and meet any additional evidence deadlines.

• Keep responses concise, factual, date-stamped, and tied to order IDs and carrier events.

Chargeback vs Refund vs A-to-z (seller comparison)

| Topic |

Chargeback |

Refund |

A-to-z Guarantee |

| Who initiates |

Customer → Bank |

Customer ↔ Seller |

Customer → Amazon |

| Who decides |

Bank |

Seller |

Amazon |

| Money flow |

Provisional credit to buyer; potential seller debit |

Seller issues refund |

Depends on case outcome |

| ODR impact |

Yes if service-related (seller-fulfilled) |

No direct |

Yes if not denied |

| Speed & control |

Slow; low control |

Fast; high control |

Medium; Amazon-managed |

| Best used when |

Buyer escalates or fraud suspected |

Clear service failure |

Seller hasn’t resolved via policy |

Chargebacks on Amazon: fraud vs service and ODR impact

Amazon buckets chargebacks broadly into two groups:

- Fraud-related (for example, stolen card). Amazon handles payment-related fraud and these disputes do not count against your ODR. You may still see accounting movements, but Account Health is not penalized for bank-confirmed fraud.

- Service-related (for example, item not received, not as described, damaged). Sellers are responsible. For seller-fulfilled orders, if the bank sides with the buyer, it counts toward ODR. For FBA, Amazon handles fulfillment and related customer service, so shipping performance metrics are not impacted by those orders.

Track your metrics and thresholds in Account Health:

Account Health page. Aim to keep

ODR < 1% over the rolling 60-day window. As a rule of thumb, if you received 300 orders in 60 days, stay under

three defects total (low-star feedback, undenied A-to-z, or chargeback claims).

Risk to avoid

Recurring service-related chargebacks on seller-fulfilled orders can threaten selling privileges. Monitor Credit card chargeback rate, audit weak ASINs, and fix root causes (ambiguous PDPs, untracked shipments, address issues) before they snowball.

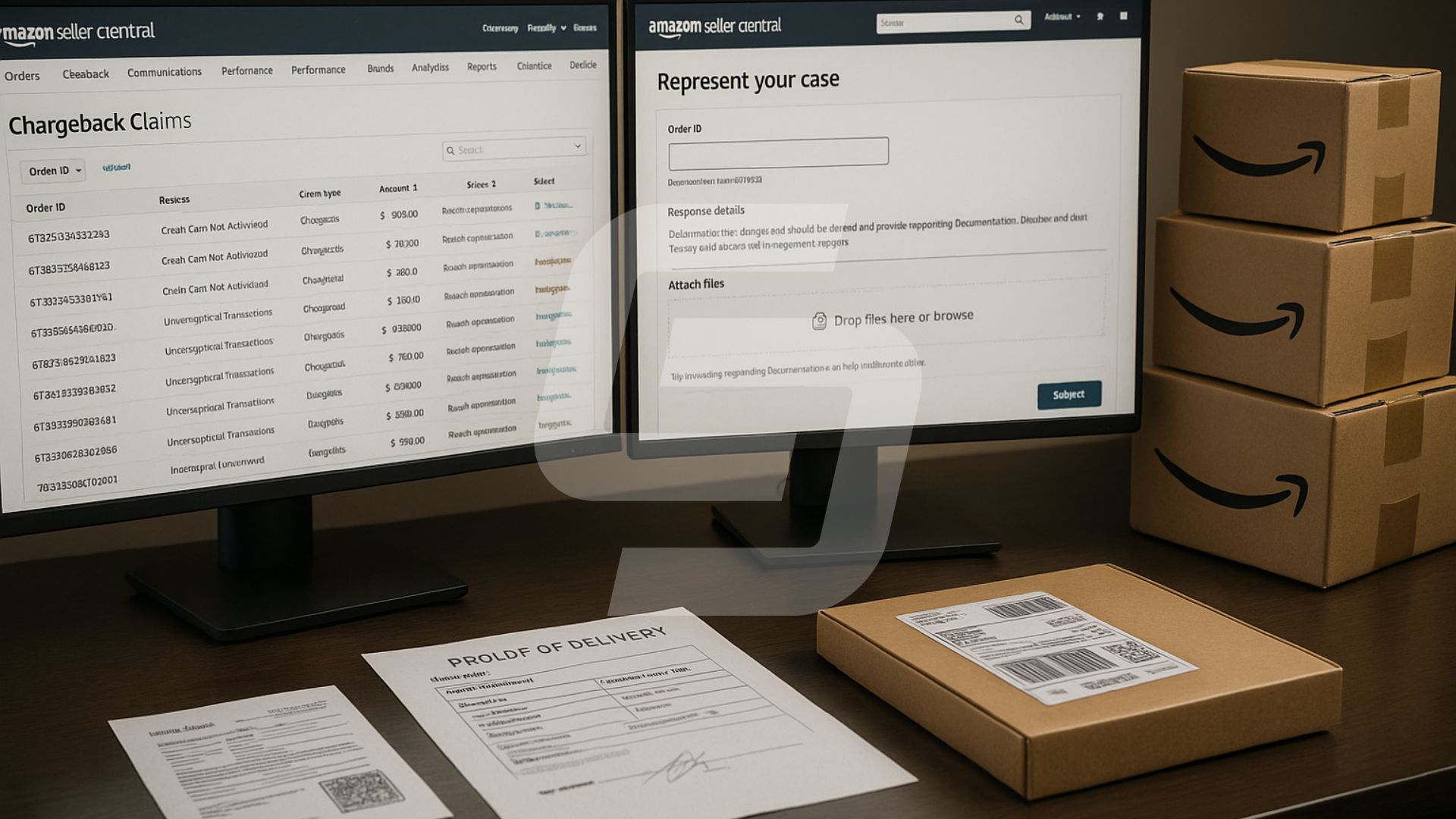

Where to see and manage chargebacks in Seller Central

There are two places you will use most often:

- Payments → Transaction View: filter Chargeback refund to list entries; drill into Transaction Details for order-level movements and related adjustments. Use the search bar for Order ID or date ranges.

- Performance → Chargeback Claims: the case list for service-related disputes, deadlines, and documentation requests. Here you track status, respond, and upload evidence packages.

You may also receive an email alert for a new case. Always reply within 7 days and attach requested documents. Late or incomplete responses are common reasons banks maintain the provisional credit to the customer.

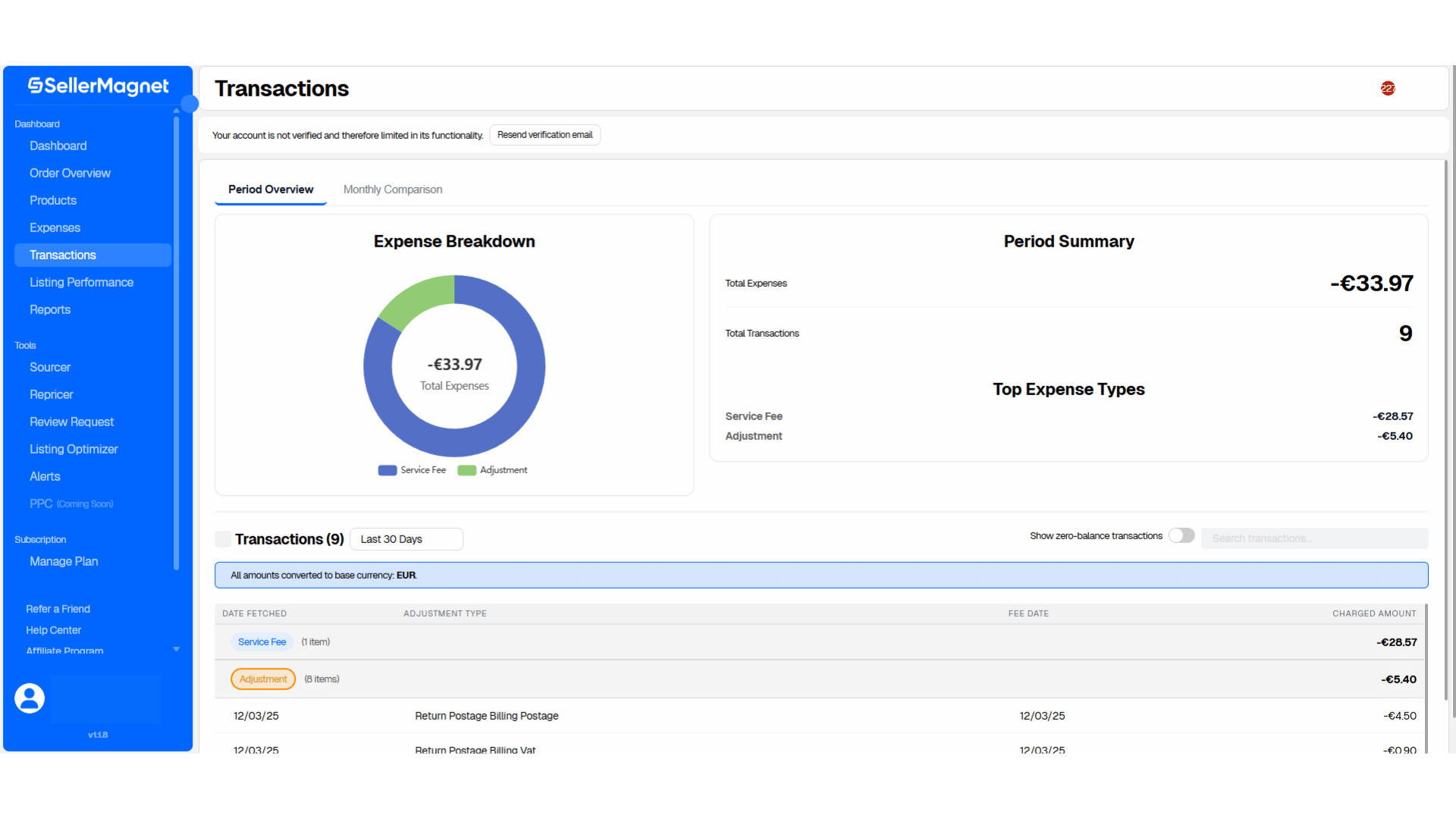

One dashboard for the full picture

To review

chargebacks, returns, refunds, ads fees, and COGS together, use the

SellerMagnet Analytics Dashboard. Get

P&L at order level, segment by SKU, and flag patterns that drive disputes:

https://sellermagnet.com/en/analytics-dashboard

How to respond: evidence, timelines, avoidable mistakes

Once you’ve reviewed the alert, you have two primary options:

- Issue a refund (Manage Returns) when evidence is weak or the service error is clear. Fast refunds can reduce repeat contacts and negative feedback.

- Represent your case with proof the transaction is valid. Submit via Amazon’s tool: Represent your case. Keep the narrative factual and structured.

Evidence checklist by scenario

- Not received: carrier tracking showing delivery, shipment date, service level, scans, and signature for high-value items. If delivery is to a reception/locker, add location notes.

- Not as described / defective: images of item as shipped, SKU/IMEI where relevant, PDP screenshots proving feature claims, what’s-in-the-box list, QC logs, and any troubleshooting offered.

- Duplicate / amount error: transaction IDs, prior credits, invoice snapshots, reconciliation notes.

- Return but no refund: return receipt, warehouse intake timestamps, refund timing policy, and processing screenshot.

Avoid these mistakes

- Responding late or with missing attachments.

- Ambiguous PDP content that contradicts what shipped.

- No trackable shipping on higher-value orders or mismatched addresses.

- Long narratives without dates, IDs, or proofs the bank can verify.

Fast win today

Create a case evidence folder template per order: tracking PDF, delivery proof, pre-ship photos, buyer comms, PDP PDF, accessory checklist, and return intake record. When an alert arrives, you respond in minutes, not days.

Prevention playbook: PDP clarity, shipping, customer care

Fix the page

Clarity reduces returns and service disputes. Tighten titles and bullets; show scale and use in secondary images; add a 30–45 sec video; include a “what’s in the box” bullet; list compatibility and dimensions; and align to Condition rules if selling used or refurbished.

Ship to expectation

Confirm shipment promptly in Seller Central; use trackable methods; require signature for high-value orders; verify addresses and apartment numbers; and keep labels accurate. Regional out-of-stock pockets and late confirmations trigger avoidable disputes.

Proactive support

Use Buyer-Seller Messaging (within policy) to clarify address issues, missing parts, or basic troubleshooting before frustration escalates. Many chargebacks happen because buyers cannot reach the seller or do not receive timely answers.

Post-purchase hygiene

Send short, helpful post-delivery messages (where permitted) and maintain a clear, visible returns process. Close the loop on returns quickly so “refund not received” never becomes a dispute.

Advanced playbooks: reason codes, timelines, root-cause review

6.1 Bank reason codes and recommended evidence

| Reason bucket |

Examples the bank sees |

What strengthens your case |

| Fraud / not recognized |

Cardholder claims they didn’t make the purchase |

AVS match, CVV match (if available), IP/region consistency, prior order history, delivery address match to cardholder, signature for high value |

| Not received / late |

No delivery or late delivery |

Carrier scans, delivered status, signature, GPS or locker info, on-time ship date, customer comms confirming receipt |

| Not as described / defective |

Item different, missing parts, DOA |

PDP screenshots, packaging photos, serial/IMEI, QC records, what’s in the box list, RMA/troubleshooting logs |

| Billing issues |

Duplicate charge or wrong amount |

Payment logs, refund IDs, invoices, reconciliation notes, credit memos |

| Refund not processed |

Return sent but no refund |

Warehouse intake scans, refund timestamp, customer notification, bank processing times |

6.2 Seven-day response timeline (service-related)

- Day 0–1: Acknowledge the alert; open a case in your internal tracker; pull order, PDP and shipment data; start evidence folder.

- Day 1–3: Gather delivery proofs, buyer comms, QC photos; draft a one-page summary with dates and references; verify refund status.

- Day 3–5: Upload to Represent your case; double-check attachments render correctly; keep narrative under one page with bullet references to exhibits.

- Day 5–7: If evidence is weak, consider a seller-initiated refund to reduce further impact. Otherwise, monitor the case and be ready to supply additional documents.

6.3 Root-cause review after resolution

Every dispute is a free audit of your process. Conduct a post-mortem:

- PDP clarity: did images, bullets, and size charts match what shipped?

- Logistics: was the ship date on time? was tracking visible? any address mismatches?

- Customer care: did the buyer reach you? how long to first response?

- Returns: was the refund issued within your SLA once the item arrived?

- Pattern: are certain SKUs or carriers over-indexed in disputes? Fix the few causes that generate most issues.

Operate from truth at order level. Combine fees, ad spend, COGS, refunds, and disputes to see where contribution erodes. The SellerMagnet Analytics Dashboard centralizes this view and helps prioritize fixes that actually move ODR and margin.

FAQ (seller-POV, quick answers)

A chargeback is a **bank-mediated** reversal that may debit your account; a refund is a **seller-initiated** resolution in Seller Central. Chargebacks can add banking costs and ODR impact if service-related.

Expect up to **~90 days** from when the cardholder files with the bank. Always answer Amazon’s alert within **7 calendar days** to keep your position active.

No. Fraud-related chargebacks are handled by Amazon and do not count toward ODR. **Service-related** chargebacks on **seller-fulfilled** orders can count.

Use the [**Account Health page**](https://sellercentral.amazon.com/help/hub/reference/external/G200285250?initialSessionID=eu%3D259-5014772-2908533&ld=NSGoogle&pageName=US%3ASD%3Ablog%2Fchargebacks&ldStackingCodes=NSGoogle). Monitor **Credit card chargeback rate** and overall **ODR** regularly, and drill down on problematic ASINs.

Submit your evidence in Amazon’s tool: [**Represent your case**](https://sellercentral.amazon.com/gp/chargebacks/home.html?initialSessionID=eu%3D259-5014772-2908533&ld=NSGoogle&pageName=US%3ASD%3Ablog%2Fchargebacks&ldStackingCodes=NSGoogle). For policy context on marketplace disputes, review [**Learn more about A-to-z Guarantee claims**](https://sellercentral.amazon.com/gp/help/external/GQ6762Y9AB2FYDY8?initialSessionID=eu%3D259-5014772-2908533&ld=NSGoogle&pageName=US%3ASD%3Ablog%2Fchargebacks&ldStackingCodes=NSGoogle).

Yes. Most reductions come from **clearer PDPs**, **trackable shipping with signatures** on higher-value orders, fast **post-delivery support**, and a **clean returns process**. You can maintain margins while lowering disputes by fixing the few root causes that drive most claims.

Recap & next steps

- Distinguish fraud vs service disputes; watch ODR < 1%.

- Centralize proofs so you can respond within 7 days.

- Fix PDP clarity, logistics, and refunds to prevent repeats.

- Operate from order-level truth with the SellerMagnet Analytics Dashboard: https://sellermagnet.com/en/analytics-dashboard

If evidence is strong, Represent your case; otherwise refund fast and move on, then run a root-cause review to avoid recurrences.

Stop Juggling Tools - SellerMagnet Combines Everything You Need in One Platform.

Join a smarter way to manage your Amazon store

Try for Free

Recommended Posts

Tags: FBA FBM Amazon Basics

What Is Amazon List Price and How Should Sellers Use It?

What is Amazon List Price, how does it differ from Typical Price, when does the strikethrough appear, and how sellers can update it safely.

Tags: FBA FBM Amazon Basics

Amazon Chargebacks: What They Are, How to Respond, and How to Reduce Them

Understand Amazon chargebacks, ODR impact, where to manage cases, what evidence to submit, and how to prevent disputes with clear PDPs and tracked shipping.

Tags: FBA FBM Advertising & PPC Inventory Management SellerMagnet Tools BuyBox

Black Friday for Amazon Sellers 2025: Plan & Win

Turn BFCM traffic into profit. Plan what to do before, during and after, choose PED vs coupons vs deals, protect Buy Box and measure true margin.

Tags: Advertising & PPC Amazon Basics

Amazon Seller Promo Codes: A Profitable How To

Learn when promo codes beat coupons: how to set single use or group codes and how to track profit with Amazon Seller PPC.

Tags: Advertising & PPC Amazon Basics

10 Advanced Amazon Seller Ads That Scale Profit

The seller guide to advanced Amazon ads. Retargeting, video, DSP, category and product targeting, bidding, and tests to scale profit.

Tags: FBA Amazon Updates Amazon Basics

Prime Big Deal Days Seller Playbook (Oct 7–8)

A practical plan for Amazon sellers to win Prime Big Deal Days: choose PED vs coupons vs Deals, scale Sponsored Products, and protect margin.

Tags: FBA Inventory Management

Give Returns a Second Life with FBA Grade & Resell

Turn Amazon FBA returns into revenue with Grade & Resell. Learn grading, pricing, eligibility, and when to use alternatives.

Tags: FBA FBM Amazon Basics

How to Optimize Customer Lifetime Value (CLV) on Amazon

A seller’s guide to raising customer lifetime value on Amazon with product ladders, reviews, Subscribe & Save, and analytics.

Tags: SellerMagnet Tools Product Research Amazon Basics

How to Find Profitable B2B Products on Amazon

A practical guide for Amazon B2B sellers: where to find products, validate margins, set business pricing, and scale with data.

Tags: FBA FBM SellerMagnet Tools Amazon SEO

Improve Conversion on Amazon: The Seller’s Playbook

Actionable steps to increase conversion on Amazon: better titles, images, A+ content, pricing tests, reviews, and analytics.

Tags: FBM Inventory Management Amazon Basics

Amazon FBM Return Codes: How to Handle Prepaid Returns

Learn how Amazon FBM return reason codes work, who pays shipping costs, and how to manage returns effectively with SellerMagnet.

Tags: FBA FBM SellerMagnet Tools Amazon Basics

White Label vs Private Label on Amazon: Complete Guide

White or private label? Guide to differences and SellerMagnet tools to succeed on Amazon.

Why Choose SellerMagnet?

With SellerMagnet, you have everything you need to dominate the Amazon marketplace and grow your business without the burden of manual management. The platform includes tools to monitor profits, optimize pricing, analyze products and gather reviews - boosting your efficiency and competitiveness.

Amazon

Analytics Dashboard

The Analytics Dashboard gives you a clear view of your finances and profits.

Amazon

Repricer

The Repricer keeps your prices competitive to boost BuyBox chances.

The SellerMagnet Sourcer helps you find profitable products with ease.

The Review Requester automates gathering customer reviews for credibility.

Compatible with all Amazon marketplaces